Advertisement

This announcement is not being made in and copies of it shall not be distributed or sent, directly or indirectly,

into the United States of America, Canada, Australia, Japan or South Africa.

MaaT Pharma launches its initial public offering

on the regulated market of Euronext in Paris

Lyon, France – October 15, 2021 – 7:30 am

- Capital increase of 2,333,333 new ordinary shares (corresponding, on an indicative basis, to an amount of approximately €35.0m [1]) which may be increased to a maximum of 3,085,831 ordinary new shares (corresponding, on an indicative basis, to an amount of approximately €46.3m in the event of the full exercise of the extension clause and over-the allotment clause[2])

- Subscription commitments received in the amount of €17.9m from historical and current shareholders

- Indicative price range applicable to the offering: between €13.50 and €16.50 per share

- Closing of Open Price Offering: on November 2, 2021 (5:00 p.m. CET for subscription over the counter and 8:00 p.m. for online subscriptions)

- Closing of the Global Placement on November 3, 2021 (12:00 pm CET)

- Eligible for the PEA and PEA-PME[3] and for the provision 150-0 B ter of CGI (reinvestment of sale proceeds)

[1]Based on the midpoint of the indicative price range.

[2] Based on the midpoint of the indicative price range.

[3] These schemes are conditional and within the limits of the ceilings available. The persons interested are invited to contact their financial advisor.

MaaT Pharma S.A. (” MaaT Pharma ” or the “Company“), a French clinical stage biotech and a pioneer in the development of microbiome[1] based ecosystem therapies dedicated to improving survival outcomes for patients with cancer, today announces the launch of its initial public offering on the regulated market of Euronext in Paris (code ISIN : FR0012634822- ticker code : MAAT). On October 14, 2021, the French Autorité des Marchés Financiers (AMF) approved the Prospectus under number 21-445 consisting of a Registration Document approved on October 1, 2021, under the number I.21-057, the supplement of the registration document approved on October 14, 2021 under number I.21 061, a Securities Note and a summary of the Prospectus (included in the Securities Note).

Hervé Affagard, Co-founder and CEO of MaaT Pharma, said:

“MaaT Pharma aims to change the global pharmaceutical industry by developing next-generation drugs based on complete microbiome ecosystems. While 25% of the world’s population suffers from an altered gut microbiota, our clinical data show that its restoration could play a major role in improving the survival outcomes for patients with acute Graft-versus-Host Disease (following a bone marrow transplant) as well as for patients fighting other liquid and solid tumors. Our proposed IPO comes at a pivotal time in our history, as first key development milestones have been achieved, with promising Phase II clinical results and the launch of a Phase III trial planned before year end. I hope that our project will attract new institutional and individual shareholders to support us in the execution of our ambitious strategy, which first and foremost aims to address major public health issues for the benefit of millions of patients.”

An innovative therapeutic approach based on microbiome modulation to improve survival in patients with liquid and solid tumors

The gut microbiota is an assembly of rich and diverse microorganisms (“ecosystem”) and contributes to maintaining a symbiosis[2] between the host and the billions of naturally present microbes in the human body. This symbiosis is essential for human health and regulates our immune homeostasis, as 80% of immune cells reside in the intestine[3], and our metabolism. A balanced symbiosis generates protection through a stronger intestinal barrier and contributes to the education and maturation of the immune system against potential pathogens. However, lifestyle, diet, or the use of toxic drugs for the microbiome can alter this symbiosis. This alteration is referred as “dysbiosis” and is notably illustrated by a loss of diversity of microorganisms. This condition represents a danger for the host because bacteria could induce deleterious, inflammatory reactions or make anti-cancer treatments less effective.

To address significant unmet medical needs in oncology, MaaT Pharma is designing an innovative therapeutic approach based on gut microbiome modulation. The company develops high-richness and high-diversity drug candidates derived from healthy donors or produced by co-fermentation, using its MET (Microbiome Ecosystem Therapy) platform.

MaaT Pharma’s lead drug candidates are:

- MaaT013 for the treatment of acute Graft-versus-Host Disease (aGvHD), ready to enter Phase III trial in the EU[4] (application of the clinical trial submitted). MaaT013 is also expected to enter a Phase II proof of concept trial to evaluate its impact on response rates to immune checkpoint inhibitors in treatment-naïve metastatic melanoma.

- MaaT033 for the improvement of survival in patients with acute myeloid leukemia (AML) or other liquid tumors receiving allogeneic hematopoietic stem cell transplantation (allo-HSCT), currently in a Phase Ib trial.

- MaaT03X, a new generation of co-fermented microbiome-based therapies to be used in combination with immuno-therapy in oncology, targeting solid tumors. The MaaT03X line is currently in preclinical testing.

[1]The microbiome (also called intestinal flora) refers to all the microorganisms (bacteria, archaea, yeasts, viruses…) naturally present in the intestine. It plays a major role in the education and modulation of the immune system and in the metabolism.

[2] Symbiosis: mutually beneficial relationship

[3] Castro G.A. & Charles J.A., Am. J. Physiol. 265 (Gastrointest. Liver Physiol. 28): G599-G610, 1993.

[4] Expansion to US sites in H2 2022 subject to lifting of FDA clinical hold

An ambitious development strategy

In a market with a strong potential and offering multiple opportunities for the Company, MaaT Pharma intends to pursue an ambitious strategy articulated around four major points:

- Focus its development on microbiome modulation in oncology (both liquid and solid tumors) in indications with high unmet medical need, to maximize its expertise and consolidate its pioneer status in the microbiome field, while preserving its competitive advantage;

- Gradually expand its product pipeline by discovering new innovative microbiome-based therapiesin hemato-oncology and immuno-oncology, leveraging its internal expertise and its proprietary technology platform. The Company’s proprietary technology platform enables to use pre-existing clinical data to significantly accelerate new drug development and reduce associated risks. The combination of gutPrint® with proprietary and exclusive cGMP manufacturing processes is used as a cornerstone to strengthen and expand the Company’s portfolio;

- Build an integrated biopharmaceutical company, which could on the one hand ultimately commercialize its most advanced products, thanks to the limited number of specialized hospital centers performing allo-HSCT and on the other hand establish potential collaboration agreements with one or more larger pharmaceutical partners, to develop and/or commercialize new drug candidates generated using its MET platform;

- Collaborate closely with regulatory agencies to enable efficient development of a new treatment modality in this pioneering field. Since 2014, MaaT Pharma has received approval to start multiple clinical trials from the ANSM and other European agencies; MaaT013 also received Orphan Drug Designation from both the FDA and EMA in 2018. Since 2018, the French regulator ANSM has enabled access to MaaT013 in aGvHD through a compassionate use (ex-« ATU nominative ») program.

An initial public offering on the regulated market of Euronext in Paris for financing growth and development

MaaT Pharma’s initial public offering is intended to provide the Company with the necessary financial resources to implement its development strategy and accelerate its growth.

Estimated net proceeds of the offering in the context of this transaction (amounting to €31.5m which may be increased to €42.0 m in the event of full exercise of the extension clause and the over-allotment option)[1] will enable MaaT Pharma to pursue the following objectives:

- nearly 2/3 for the company’s clinical programs, including the Phase III of MaaT013, initiation of Phase II/III of MaaT033 and preparatory works for Phase I of MaaT03X, including current expenditure related to these activities;

- over a third for industrial scale-up of MaaT013, MaaT033 and MaaT03X production including lump sum payments related to the building of modular buildings for pharmaceutical use and associated process equipment and current expenditures related to these activities.

The Company has received subscription commitments up of €17.9m from historical and current shareholders

The Company has received subscription commitments of approximately €17.9m (i.e. approximately 51.2% of the amount of the initial offering based on the mid-point of the indicative price range), at any price within the price range of the Offering, from historical investors:

| Investors | Subscription undertakings in cash |

| Seventure Partners (Health for Life Capital) | €4.9m |

| SymBiosis | €4.6m |

| Biocodex | €2.3m |

| Bpifrance | €2.5m |

| Crédit Mutuel Innovation | €3.0m |

| Skyviews | €0.4m |

| Celeste | €0.3m |

In addition, Eurekare, a company focused on financing biotechnology companies in the fields of the microbiome and synthetic biology, has made a commitment to place an order of €1.0 million.

[1] Based on the midpoint of the indicative price range.

Eligibility of the offering for the PEA and PEA-PME

MaaT Pharma announces that it fulfils the eligibility criteria for the PEA-PME scheme provided under Articles L.221-32-2 and D.221-113-5 et seq. of the French Monetary and Financial Code. Therefore, the shares of MaaT Pharma can be fully integrated into equity savings plans (plans d’épargne en actions, PEA) and PEA-PME accounts, which benefit from the same tax benefits as the classic PEA.

Availability of the prospectus

The registration document of the Company approved by the AMF on October 1, 2021, under the number I.21-057, the supplement of the registration document approved by the AMF on October 14, 2021, under the number I.21-061, the security notes and the summary of the prospectus are available free of charge and on simple request from MaaT Pharma and on the following websites: www.amf-france.org and investir.maatpharma.com. The approval of the Prospectus should not be considered as an endorsement on the securities offered or admitted to trading on the regulated market of Euronext Paris.

Risk factors

The Company draws the public’s attention to the risk factors described in Chapter 3 of the Registration Document approved by the AMF and the Chapter 3 of the supplement of the registration document approved by the AMF, as well as Section 2 « Facteurs de risques de marché pouvant influer sensiblement sur les valeurs mobilières offertes » of the Securities Note. Potential investors are invited to read the prospectus before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the Company’s securities. The occurrence of one or more of these risks may have a material adverse effect on the business, results, financial conditions and prospects of the Company and on the value of its securities.

Net working capital

The Company draws the public’s attention to the fact that:

- The Company does not have sufficient net working capital to meet its commitments and operating cashflow needs for the next twelve months. The cash and cash equivalents available to it as of August 31, 2021, i.e., of €15.3m, will enable it to cover its cash requirements until the end of the first quarter of 2022, taking into account the first payment of €478,498 of a €1,913,993 grant from Bpifrance granted in July 2021 and unavoidable inherent costs incurred by the Company in the context of the public offering whether it occurs or not, of around €1.1m;

- The additional funding required to continue operations in accordance with the business plan as described herein for the twelve-month period following the approval of the prospectus by the AMF is estimated to be €15m from April 2022 to end of October 2022. This amount includes (i) operating expenses for the period concerned (ii) debt financing repayments of 0.7 million euros(iii) lump sum payments related to the construction of modular pharmaceutical buildings complying with cGMP regulations, as defined in the term sheet signed with Skyepharma on September 30, 2021, and the acquisition of process equipment by the Company, totalling €3.0m;

- This amount of €15m will be funded from the net proceeds from the Offering amounting to €5m (on the basis of a capital increase subscribed at 100% at the median price, net of estimated fees associated with the Offering), which will enable the Company to continue operations until the end of the third quarter of 2023.

Should the capital increase be subscribed at 75% and at the low-end of the price range of €13.50 per share, i.e., €20.6m (net of the incompressible costs inherent to the initial public offering project), the Company will proceed with certain modifications described under note 3.4 of the Prospectus in order to pursue key activities and projects.

Financial intermediaries and advisors

Find all the information relative to the project of MaaT Pharma’s IPO on:

https://investir.maatpharma.com

MAIN TERMS AND CONDITIONS OF THE TRANSACTION

- SHARE CAPITAL BEFORE THE TRANSACTION

Société anonyme à conseil d’administration (French corporation), with share capital of €671,332 divided into 6,713,320 shares of €0.10 each.

- CHARACTERISTICS OF THE SHARE

- Label: MAAT PHARMA

- Mnemonic code: MAAT

- ISIN code: FR0012634822

- Listing market: Euronext Paris

- ICB Classification: 20103010 – Biotechnology

- LEI: 969500CQQB6XUNW6CN97

- Eligibility for PEA “PME-ETI” scheme [1]

- INDICATIVE PRICE RANGE

Between €13.50 and €16.50 per new share, as decided by the board of directors on October 14, 2021. This information is given purely for information purposes and should not, in any circumstances, be considered an indication of the offering price, which may be set outside this indicative range.

- INITIAL SIZE OF THE OFFERING

All the existing ordinary shares of the Company comprising the Company’s share capital will be admitted to trading. The Offering shall be carried out through the issuance of 2,333,333 new shares (corresponding, on an indicative basis, to an amount of €35.0m, issue premium included)[2] which may be increased to a maximum amount of 2,683,332 new shares in the event that the Extension Clause is exercised in full, representing up to 15% of the number of new shares.

OVER-ALLOTMENT OPTION

In order to cover possible over-allotments, the Company will grant to Portzamparc (the “Stabilizing Agent“), in the name and on behalf of the Joint Global coordinators and Joint bookrunners, an option allowing the acquisition of a number of shares representing a maximum of 15 % of the cumulated number of new shares that may result from the possible exercise of the Extension Clause, i.e., a maximum of 402,499 additional shares sold, thus facilitating the stabilization transactions (the “Over-Allotment Option“).

This Over-Allotment Option may be exercised, in whole or in part, at the offering price, once at any time by the Stabilizing Agent, in the name and on behalf of the global coordinators and associated bookrunners, as from the determination of the offering price and until the 30th calendar day following the start of the trading of the shares of the Company on Euronext in Paris, i.e. from November 8, 2021 until December 8, 2021 inclusive, and carry out stabilization transactions in order to stabilize or support the price of the shares of the Company on the regulated market of Euronext in Paris within the limit of the Offering price, in accordance with the applicable legal and regulatory provisions (in particular those of Regulation (EU) No. 596/2014 of the European Parliament and of the Council as supplemented by Delegated Regulation No. 2016/1052 of the European Commission of March 8, 2016.

In the event of the exercise of the Over-Allotment Option, this information will be disclosed to the public by means of a press release issued by the Company.

- GROSS AMOUNT OF THE TRANSACTION

An amount of approximately €35.0m which may be increased to approximately € 40.2m in the event of full exercise of the Extension Clause and to an amount of approximately €46.3m in the event that the Extension Clause and the Over-Allotment Option (based on the mid-point of the indicative price range) are fully exercised.

- NET PROCEEDS OF THE ISSUE

A net amount of approximately €31.5m which may be increased to approximately €36.3m in the event of full exercise of the Extension Clause and to an amount of approximately €42.0m in the event that the Extension Clause and the Over-Allotment Option (based on the mid-point of the indicative price range) are fully exercised.

[1] This scheme is conditional and within the limits of the available ceilings. Those interested are asked to contact their financial advisor.

[2] Based on the midpoint of the indicative price range

STRUCTURE OF THE OFFERING

It is envisaged that the offering of new shares will be distributed as part of a global offering (the “Offering”), which shall include:

- a public offering in France in the form of an open price offering, mainly intended towards individuals (the “Open Price Offering” or “ OPO”), being specified that:

- the orders will be broken down according to the number of shares requested: A1 Order fraction (from 1 share up to and including 200 shares) and A2 Order fraction (over 200 shares);

- the A1 Order fractions will benefit from preferential treatment compared to the A2 Order fractions in the event that all orders cannot be fully satisfied.

- A Global Placement mainly to institutional investors (the “Global Placement”) comprising:

- a private placement in France; and

- an international private placement in certain countries, outside, in particular, the United States, Japan, Canada and Australia

Consequently, if demand for the OPO so permits, the number of shares allocated in response to orders issued as part of the OPO will be at least equal to 10% of the number of Offered Shares as part of the Offering (before any exercise of the Extension Clause and the Over-Allotment Option).

REVOCATION OF SUBSCRIPTION ORDERS

The subscription orders placed online within the Open Price Offering will be revocable. Each financial intermediary determines the conditions under which orders transmitted may be revoked. It is therefore up to the investors wishing to revoke their orders to contact their financial intermediary.

Any order placed within the Global Placement may be revoked with the financial intermediary having received this order until November 3, 2021, at 12:00 p.m. (Paris time), unless the Global Placement is closed earlier or extended.

LOCK UP COMMITMENTS

-

- Lock-up commitment by the Company: 180

- Lock-up commitment for historical shareholders of the Company: 180

- Lock-up commitment for management and employees: 180

SUBSCRIPTION UNDERTAKINGS

The Company has received subscription undertakings in the amount of € 17.9m (i.e. approximately 51.2% of the amount of the initial Offering based on the midpoint of the indicative price range of the Offering and around 76% of the amount of the initial Offering subscribed at the low end of the indicative price range of the offering), at any price within the price range of the Offering, from:

- Funds managed by Seventure Partners SA for an amount of €9m;

- SymBiosis, LLC for an amount of €6m;

- Biocodex SAS for an amount of €3m;

- Bpifrance for an amount of €5m, via the PSIM Fund;

- Crédit Mutuel Innovation for an amount of €0m;

- Céleste Management SA for an amount of €3m;

- Skyviews Life Science Ltd. €4m.

In addition, Eurekare, a company focused on financing biotechnology companies in the field of the microbiome and synthetic biology, has made a commitment to place an order of approximately €1m.

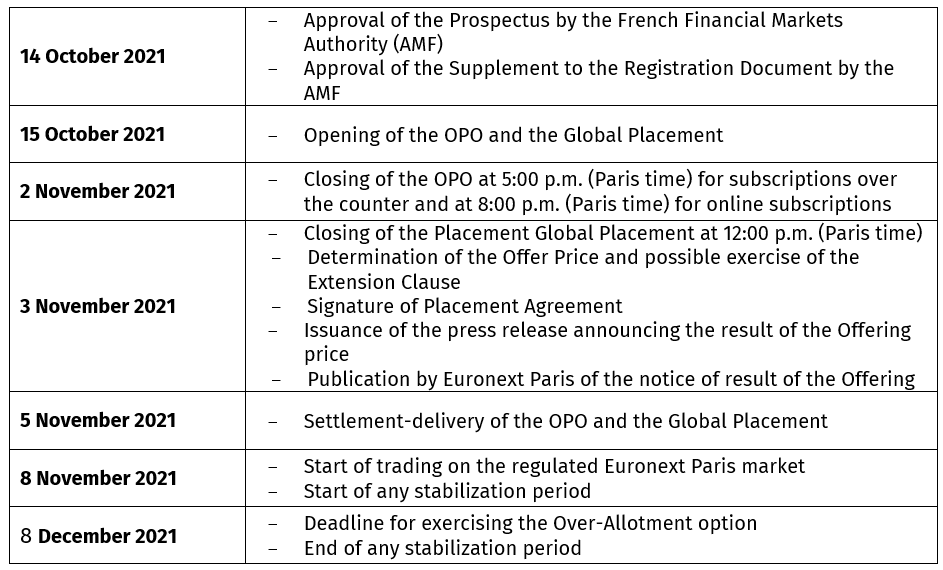

INDICATIVE CALENDAR

Forward Looking Data

This press release contains forward-looking statements, including statements about the expected closing of the Offering and the anticipated use of proceeds from the Offering. These forward-looking statements can be identified by the use of forward-looking terminology, including the words ‘believe’, ‘estimate’, ‘anticipate’, ‘expect’, ‘intend’, ‘may’, ‘will’, ‘plan’, ‘continue’, ‘ongoing’, ‘possible’, ‘predict’, ‘plans’, ‘target’, ‘seek’, ‘would’ or ‘should’, and contain statements made by the Company regarding the intended results of its strategy. By their nature, these forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. Factors that could cause actual results to differ materially from those described or projected herein include risk associated with market and other financing conditions, risks associated with clinical trials and regulatory reviews and approvals, and risk related to the sufficiency of the Company’s existing cash resources and liquidity. A further list and description of these risks, uncertainties and other risks can be found in the Company’s regulatory filings with the French Autorité des Marchés Financiers. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update or revise forward-looking statements as a result of new information, future events or circumstances, or otherwise, except as required by law.

Disclaimer

This announcement is not being made in and copies of it may not be distributed or sent, directly or indirectly, into the United States of America, Canada, Australia, Japan or South Africa.

The distribution of this document may be restricted by law in certain jurisdictions countries or constitute a breach of applicable law. Persons into whose possession this document comes are required to inform themselves about and to observe such restrictions. The information contained in this document does not constitute an offer of securities for sale in the United States of America, Canada, Australia, Japan or South Africa.

No communication and no information in respect of the issue, offering and placement by the Company of its shares (the “Shares”) may be distributed to the public in any jurisdiction where a registration or approval is required. No steps have been or will be taken outside of France in any jurisdiction where such steps would be required. The offering and subscription of the Shares may be subject to specific legal or regulatory restrictions in certain jurisdictions. The Company assumes no responsibility for any violation of any such restrictions by any person.

This announcement is not a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and the Council of June 14, 2017, as amended (the “Prospectus Regulation”).

This information does not contain a solicitation for money, securities or other consideration and, if sent in response to the information contained herein, will not be accepted.

For the United States and certain other countries:

This announcement, the information set forth herein or the prospectus referenced herein do not constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, South Africa or the United States of America or in any jurisdiction in which such offer or solicitation is unlawful. The securities issued by the Company referred to herein may not be offered or sold in the United States of America absent registration under the US Securities Act of 1933, as amended (the “Securities Act”) or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada, Japan or South Africa or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada, Japan or South Africa. The securities issued by the Company referred to herein have not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada, Japan or South Africa. There will be neither a registration, in whole or in part, of the offer mentioned in the present announcement in the United States of America nor a public offer of the securities issued by the Company in the United States of America.

For the EEA:

With respect to the Member States of the European Economic Area other than France (each, a “relevant Member State”) no action has been undertaken or will be undertaken to make an offer to the public of the securities requiring a publication of a prospectus in any relevant Member State. As a result, the Shares can only be offered and will only be offered in relevant Member States (a) to legal entities that are qualified investors as defined in the Prospectus Regulation, or (b) in accordance with the other exemptions of Article 1(4) of the Prospectus Regulation.

For the purposes of this paragraph, the notion of an “offer to the public of Shares” in each of the relevant Member States, means any communication to persons in any form and by any means, presenting sufficient information on the terms of the offer and the Shares to be offered, so as to enable an investor to decide to purchase or subscribe for those securities.

This selling restriction comes in addition to the other selling restrictions applicable in the relevant Member States.

This announcement is solely an advertisement and does not constitute a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Directive 2003/71/EC, as amended (the “Prospectus Regulation”). Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of all information contained in the prospectus, approved by the French Autorité des marchés financiers (“AMF”) on October 14, 2021 under number 21-445 (the “Prospectus”), comprising a registration document registered with the AMF on October 1, 2021 under number I.21-057 and the supplement to the registration document registered with the AMF on October 14, 2021 under number I.21-061 (the “Registration Document”) and a securities note (the “Securities Note”) including a summary of the Prospectus, and published by the Company in connection with the offering of such securities, in order to fully understand the potential risks and rewards associated with the decision to invest in the securities. Prospective investors must be able to bear the economic risk of an investment in the shares of the Company and should be able to sustain a partial or total loss of their investment. The approval of the Prospectus by the AMF should not be understood as an endorsement of the securities offered.

For the United Kingdom:

In the United Kingdom, this document does not constitute an approved prospectus for the purpose of and as defined in section 85 of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”), has not been prepared in accordance with the Prospectus Rules issued by the UK Financial Conduct Authority (the “FCA”) pursuant to section 73A of the FSMA and has not been approved by or filed with the FCA or any other competent authority. The new and existing shares in the Company may not be offered or sold and will not be offered or sold to the public in the United Kingdom, save in the circumstances where it is to be lawful to do so without an approved prospectus (within the meaning of section 85 of the FSMA) being made available to the public before the offer is made. This press release and the information it contains are being distributed to and are only intended for persons who are (x) outside the United Kingdom or (y) in the United Kingdom who are qualified investors (as defined in the Prospectus Regulation as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018) and are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), (ii) high net worth entities and other such persons falling within Article 49(2)(a) to (d) of the Order (“high net worth companies”, “unincorporated associations”, etc.) or (iii) other persons to whom an invitation or inducement to participate in investment activity (within the meaning of Section 21 of the Financial Services and Market Act 2000) may otherwise lawfully be communicated or caused to be communicated (all such persons in (y)(i), (y)(ii) and (y)(iii) together being referred to as “Relevant Persons”). Any invitation, offer or agreement to subscribe, purchase or otherwise acquire securities to which this press release relates will only be engaged with Relevant Persons. Any person who is not a Relevant Person should not act or rely on this press release or any of its contents.

For France:

Copies of the Prospectus are available, free of charge, from the Company’s registered office (70 Avenue Tony Garnier, 69007 LYON, +33 4 28 29 14 00) and may, subject to the usual limitations, be downloaded from the websites of the Company (www.maatpharma.com) and of the AMF (www.amf-france.org). The Company draws the public’s attention to the risk factors described in the Prospectus and in particular to most important risk factors, the disclosure of which may be required by the AMF.

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer”(for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares offered in the offering (the “Offered Shares”) have been subject to a product approval process, which has determined that the Offered Shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, distributors should note that: the price of the Offered Shares may decline and investors could lose all or part of their investment; the Offered Shares offer no guaranteed income and no capital protection; and an investment in the Offered Shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment for any particular client of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation

to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the Offered Shares.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares and determining appropriate distribution channels.

For the avoidance of doubt, even if the target market includes retail investors, the manufacturers and the distributors have decided they will only procure investors for the Offered Shares who meet the criteria of eligible counterparties and professional clients.